TITLE INSURANCE

What is it and why do I need it?

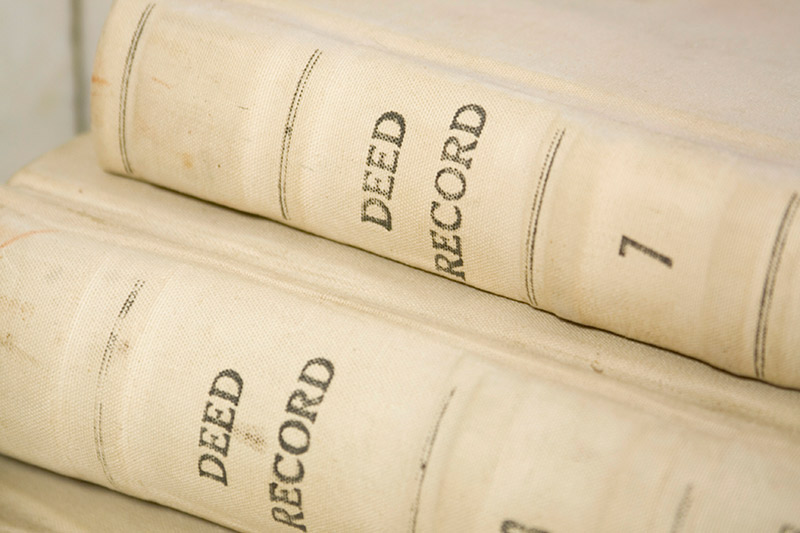

Title insurance protects against risks hidden at the time of the property purchase. Any hidden risks could possibly lead to significant financial loss or even loss of title to the property.

Your title insurance will pay for defending you against any lawsuits attacking the title as insured, and will either clear up the title problem or pay the insured’s losses. Title insurance is a one time fee and the policy remains in effect as long as you or your insured heirs retain an interest in the property.

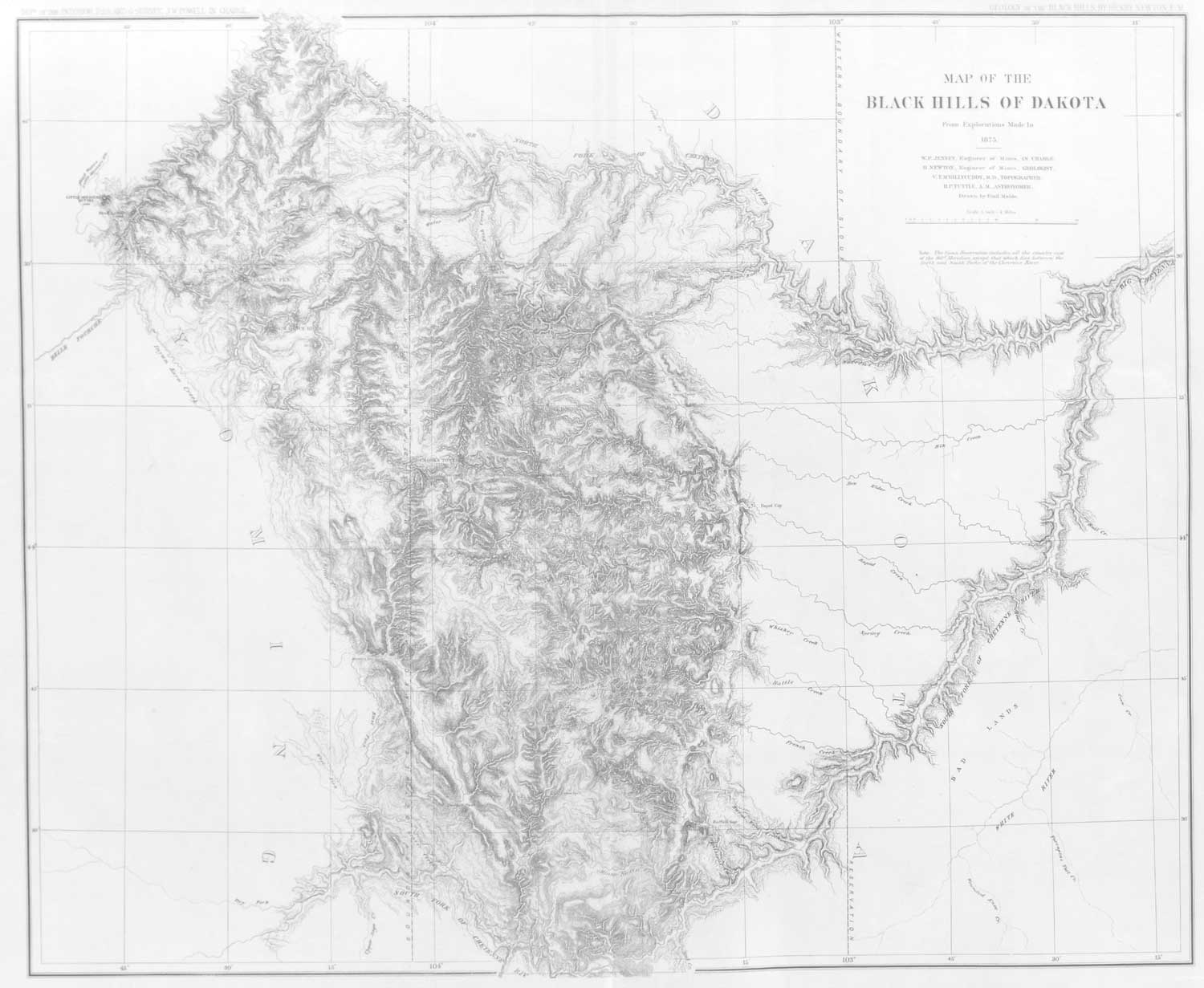

Title insurance is only issued after a careful examination of the public records. The most thorough search cannot eliminate all risks despite the knowledge and experience of professional title examiners. Hidden risks may exist that cannot be found in the public record. These risks necessitate the need for title insurance.

Types of Title Insurance

There are three types of title insurance, with each type covering different things.

1. Standard lender's policy

Lender's title insurance is required on most transactions. The lender's policy protects the lender exclusively. The lender’s policy doesn't protect the owner’s equity in the property. Examples of hidden risks covered include:

- Fraud and Forgery

- Lack of Delivery of a Deed or other Defective Conveyances

- Legal Incompetence

- Minority of Previous Owners

- Unknown or Undisclosed Heirs

- Errors Made in the Records By Public Officials

- Other Risks Which are Not Discoverable By a Search Of The Public Record

Owner's title insurance protects you against hidden risks. Examples of hidden risks include:

- Fraud and Forgery

- Lack of Delivery of a Deed or other Defective Conveyances

- Legal Incompetence

- Minority of Previous Owners

- Unknown or Undisclosed Heirs

- Errors Made in the Records By Public Officials

- Other Risks Which are Not Discoverable By a Search Of The Public Record

An extended policy goes above and beyond the protections of a standard policy. Additional steps are taken to protect your new investment. Examples of risks covered, but not limited to, include:

- Mechanic's liens and unrecorded liens

- Unrecorded easements and access rights

- Defects and other unrecorded documents

- Survey and use rights and encroachments

CLOSING AND SETTLEMENT SERVICES

SoDak Title offers flexible closing dates and times. We also accommodate “mail away” closings for buyers and sellers who are unable to attend closing. We understand our customers are busy and we work diligently to accommodate requests.

Closing services are offered on the following transactions:- Cash Transactions

- Contract for Deed Closings

- Lender Financed Closings

- Purchases

- Refinances

- Home Equity Loans

- Construction Loans

- Commercial Loans

- 1031 Tax Deferred Exchanges

- Witness Only Closings

What to bring to closing:

SoDak Title requires an unexpired photo ID for all closings.

Acceptable Forms of ID Include:- State Driver’s License

- State Issued Identification card

- US Passport

- Military Identification Card

- Resident Alien Card

CONSTRUCTION LOAN DISBURSEMENT SERVICES

SoDak Title offers construction loan disbursement services.

- Provide initial Lender/Owner Construction Agreement for Services

- Process each draw, ensuring that all receipts are attached and disbursement is properly authorized by all parties.

- Disburse each draw with funds received from Lender or Owner

- Obtain Lien Waivers from draw payees

- Obtain Final Lien Waivers upon construction completion

- Monitor the project for mechanic’s liens

- Title Update for each disbursement

- Endorsement to loan policy to give mechanic’s lien coverage for the amounts disbursed

- Contact us today to begin your construction project!